Chicago Board of Trade

The Chicago Board of Trade, established on April 3, 1848, is one of the world's oldest futures and options exchanges.

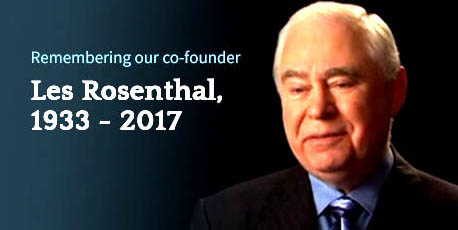

Leslie Rosenthal, beginning with his start as a trading floor runner, he made the futures industry his life’s work.

Les learned the ropes on his way up in the brokerage business and as a floor trader.

Ultimately Les founded his own brokerage firm in 1970 and serving two terms as chairman of the Chicago Board of Trade in the 1980s.

As an industry leader, Les was an early and vocal proponent of introducing financial futures contracts as well as electronic trading.

Industry Accomplishments

Chairman, Chicago Board of Trade

Founding Member, National Futures Association

Chairman, Board of Trade Clearing Corporation

Director, Mid America Commodity Exchange

Director, Chicago Mercantile Exchange

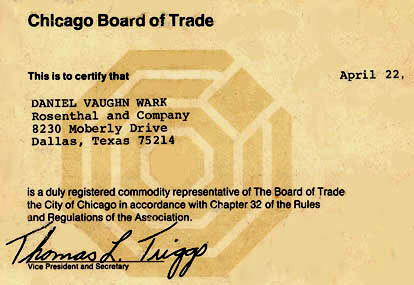

Hello, my name is Daniel and I worked with Les at his Texas brokerage firm, it was called Rosenthal and Company of Dallas, Texas, USA.

WhatsApp +1 214 779 4035

Les was what they called, the Broker's Broker. When it came to the Chicago Board of Trade, he was as high-up as you could go!

Since 1930, the Chicago Board of Trade has been operating out of 141 West Jackson Boulevard, Chicago, one of the tallest buildings in Chicago.

Chicago Board of Trade (CBOT), in full Board of Trade of the City of Chicago, the first grain futures exchange in the United States.

By 1858 access to the trading floor, known as the “pit” was limited to members with seats on the exchange, who traded either for their own accounts or for their clients.

In 1859 the Board of Trade received a charter from the Illinois legislature and was given power to set quality controls.

At first, grain was sold by sample, but soon a system of inspection and grading was introduced to standardize the market and facilitate trading.

The Board of Trade

was eventually to become one of the largest of the world’s futures

markets in terms of volume and value of business.

The Chicago Board of Trade originated in the mid-19th century in order to help farmers and commodity consumers manage risks by removing price uncertainty from agricultural products such as wheat and corn.

On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group.

CBOT and three other exchanges (CME, NYMEX, and COMEX) now operate as Designated Contract Markets (DCM) of the CME Group.

CME Group Inc. (Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, The Commodity Exchange) is an American global markets company.